Latest News from the Gambling World | Gambling.com USA

3 min read

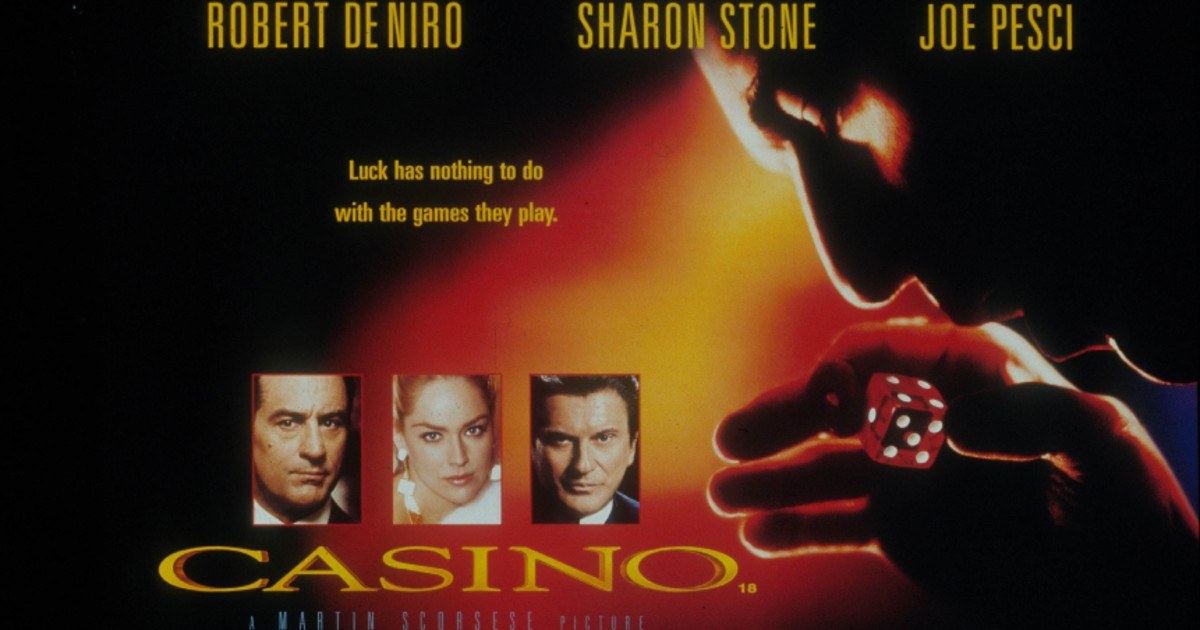

Some classic casino sites seen in movies are still around in Las Vegas and London.

3 min read

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

3 min read

Bettors are wondering what will happen to their previous Arkansas sports betting accounts. Here are...

2 min read

By mid-March, DraftKings and FanDuel might be able to accept sports bets in Arkansas.

2 min read

DraftKings, FanDuel apps could be available in Arkansas in time for March Madness.

2 min read

The NHL regular season ends April 16, followed by the Stanley Cup playoffs.

3 min read

The Arkansas Racing Commission meeting is set for 11 a.m. CT on Thursday in Little Rock.

2 min read

The fight this September will be streamed live on Netflix.

3 min read

DraftKings and FanDuel would be allowed to operate in Arkansas immediately upon Racing Commission ap...

2 min read

If approved, DraftKings and FanDuel could begin operating mobile sports betting in Arkansas right aw...

3 min read

Circus Circus bucks trend toward higher prices on Las Vegas Strip.

2 min read

Team USA is one of the favorites to take home a medal from the 2026 Winter Olympics in Italy.

2 min read

The Athletics will play the Brewers and Rockies in Las Vegas this summer.

2 min read

Gambling.com looks at customer reviews to find out which tribal casino is luckiest.

2 min read

Major League spring training begins this week, and college games are underway.

2 min read

Super Bowl 60 between the Patriots and Seahawks is set for Feb. 8 in Santa Clara, CA.

1 – 15 out of 60