DraftKings Chips Away At FanDuel’s Sports Betting Lead

Since the fall of PASPA, the U.S. sports betting market has been a two-horse race between FanDuel and DraftKings. Thus far, FanDuel has racked up more wins, gobbling up more market share in almost every state than any other operator.

Per Eilers & Krejcik Gaming, the two control nearly 75% of the U.S. sports betting market. FanDuel has a 47% market share, with DraftKings at a distant but respectable 27%. BetMGM comes in third, with around a 12% share, leaving another 14% for the dozens of other operators to chop up.

DraftKings Closes the Gap on FanDuel in U.S. Sportsbooks Race

Like any good rivalry, the upper hand will ebb and flow. And DraftKings Sportsbook is beginning to make some inroads, particularly in the Northeast.

Using its home-field advantage, the Boston-based company has been tops in the Massachusetts market, with about a 50% market share, since mobile betting launched in March.

DraftKings also moved past FanDuel Sportsbook in New York, the country's largest legal sports betting market in June. FanDuel owned New York for the first 18 months of the market’s existence, but DraftKings edged out its rival by $76 million in June, $488 million to $412 million.

FanDuel has reclaimed the lead in the first couple weeks of July (New York reports revenue weekly). Still, the situation reminds me of what a former PokerStars insider once told me, if anyone began closing the cash game traffic gap, PokerStars would give away bonuses or run a special tournament to increase play and reactivate players. The strategy was bad for the bottom line but good for optics, and as I’ll explain a little later, it’s also great for freezing out competition.

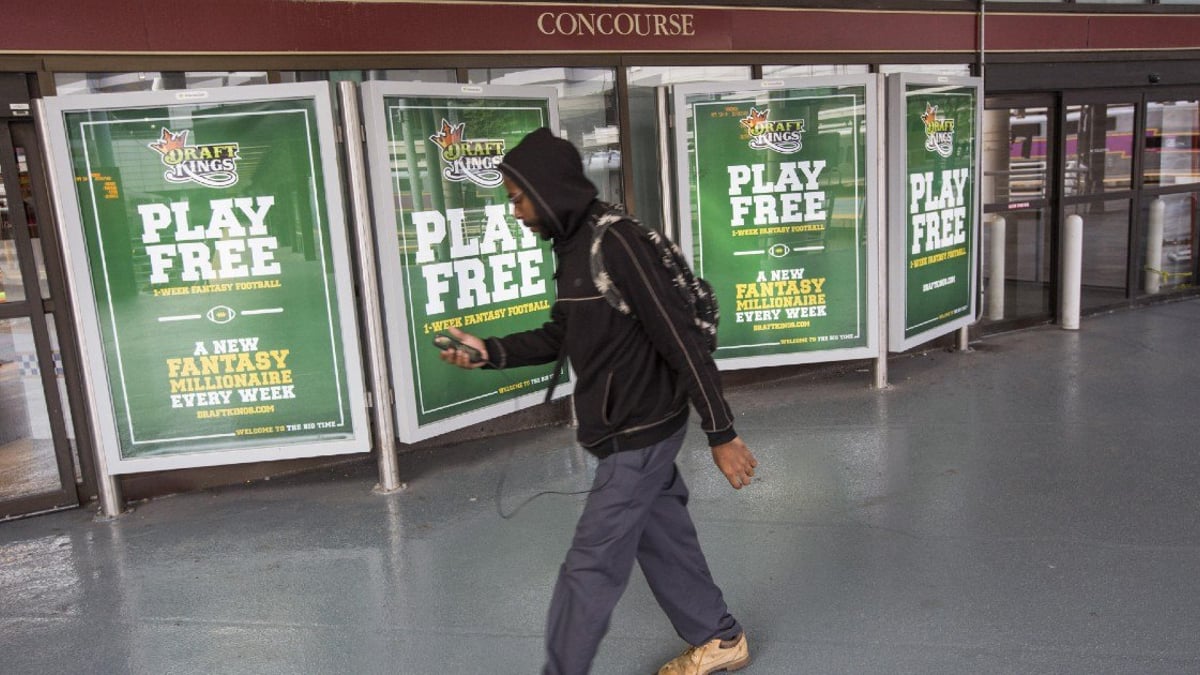

Marketing isn’t the only way to bring in players and win battles and, eventually, the war.

Marketing is certainly a factor in DraftKings’ ability to close the gap with FanDuel. Still, Jed Kelly, the managing director of equity research at Oppenheimer, wrote, “We view (DraftKings) overtaking (FanDuel) in New York handle share as a leading indicator that product quality is winning out.”

Eilers & Krejcik Gaming has long noted FanDuel’s early-mover advantage in single game parlays, as a key part of the secret sauce in the company’s US success. But EKG has also pointed out that the SGP lead (time and tech) is now being chipped away at by DraftKings.

That said, the two products test very similarly in EKG’s proprietary app testing.

That raises several questions on the marketing front. Is DraftKings outspending FanDuel in Massachusetts? Did DraftKings massively increase its spending in New York in June, with FanDuel doing the same in July?

Sportsbooks Use Promotions to Lure New Customers

The amount of marketing can have a profound impact on the betting handle. Bonus dollars turn non-bettors into bettors (or reactivate lapsed customers), and that money is constantly recycled until it disappears, thereby boosting an operator’s betting handle.

My anecdotal experience with Massachusetts sports betting advertising leads me to believe DraftKings is handing out more free money in the Bay State than FanDuel. FanDuel and DraftKings offered me several too-good-to-be-true promotions in the opening days of the market. The offers from FanDuel disappeared quickly, while DraftKings is still sending multiple offers a week.

The previous story about PokerStars explains how a company can use marketing to play with some top line numbers. It also helps explain how the most prominent players in the market can weaponize their marketing budgets to overwhelm the competition and keep upstarts from testing the waters.

Deep-pocketed operators willing to suffer significant early losses can make a market inhospitable for their peers that need to be more cautious with their money. And thus far, it’s apparent that if you can’t compete in marketing, you will have difficulty competing in U.S. sports betting.

Operators that try to play the waiting game will run into a different set of problems. Peeling customers away from existing operators is difficult without a carrot, like bonus dollars.

Furthermore, the bettors that “follow the money” and take advantage of the bonuses and promotions tend to lack loyalty. For a smaller operator, the trick is to have a product that the customer prefers, so when the bonus money runs dry, they continue to use your product.

Unfortunately, for any operator trying to employ that strategy, DraftKings and FanDuel are not just the biggest spenders in the U.S. sports betting space; they are among the top-ranked sports betting apps. So, when an operator decides to get into the spending game, they attract customers, but when the bonus money is gone, they return to DraftKings and FanDuel.

The result is that they lose at your site (leading to a negative experience) and return to DraftKings and FanDuel, or they take their winnings from your site to DraftKings and FanDuel.

Final Thought

DraftKings has a long way to go to catch FanDuel, and its recent gains may be heavily influenced by marketing.

But the overarching question is, what happens to FanDuel and DraftKings’ customer base when they inevitably cut back on bonuses?