West Virginia Wants To Increase iGaming And Sports Betting Taxes To 25%

West Virginia lawmakers will debate two bills, HB 4397 and HB 4398, that look to increase betting taxes levied against operators.

If passed, the bills would increase sports betting tax from 10% to 25%, while online casino operators would see their rates increase from 15% to the same 25% rate.

Currently, the Mountain State has some of the lowest gambling tax rates in the country, and while the increases would be significant, the resulting rates would still not compete with the highest levels.

West Virginia Gambling Tax Rates

West Virginia is just one of a growing number of states making similar moves.

Massachusetts is vying to increase its rate to a staggering 51%, which would be among the highest in the country, while Illinois has tabled a tiered taxation system that would range from 20% to 40%.

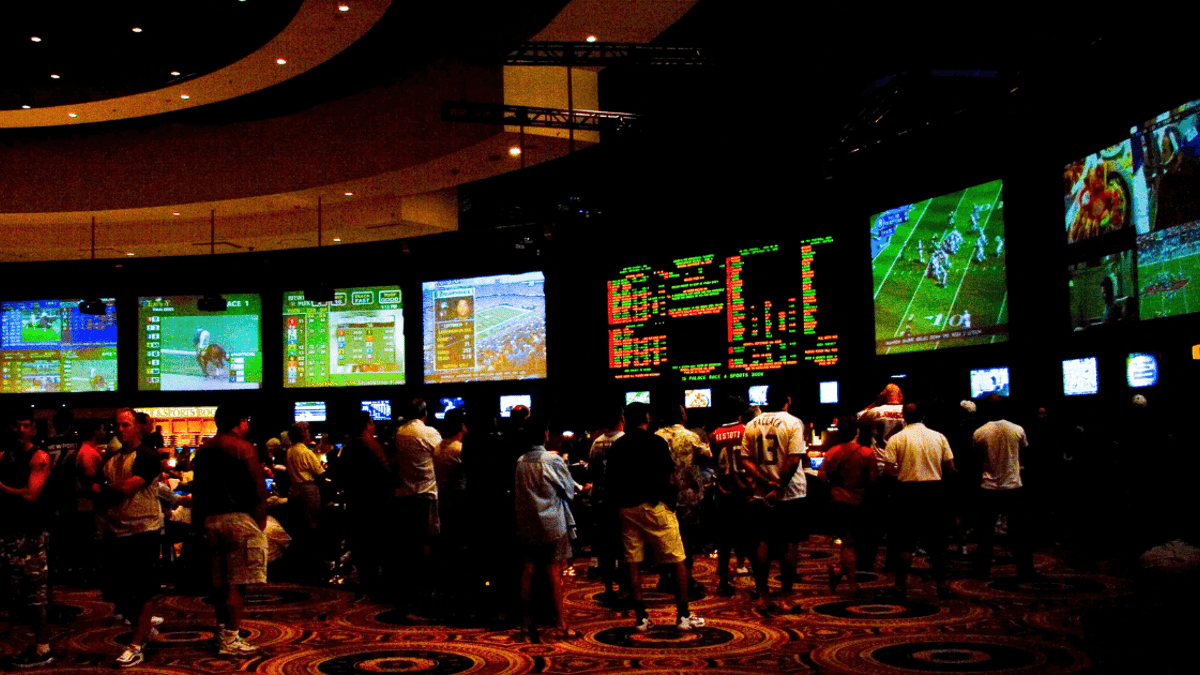

West Virginia passed sports betting regulations in 2018, with retail sports betting launching later in the year, quickly followed by mobile sports betting.

In February 2019, the passing of HB 2934 meant West Virginia became the fifth state to regulate iGaming, and the first online casinos went live in July 2020.

Ever since iGaming was introduced, West Virginia licensed operators have enjoyed the same tax rate - 15% of adjusted gross revenue. Similarly, sportsbooks have had the same 10% tax rate.

All operators are required to report revenues each week and pay their tax revenue by the following week.

These requirements would not change under the proposals, but base tax rates would.

While You Are Here, Why Not Check Out Our: Casino Games Hub & Free Slots?

How It Compares

Sponsored by Delegate Chris Burkhammer, the proposals would bring West Virginia in line with other states.

Under the current rates, they are seen as having one of the most operator-friendly environments with some of the lowest tax requirements.

While the rates would more than double the amount of tax paid by operators, in the case of sports betting, the amended rate would still be reasonable compared to other markets.

New York, New Hampshire, and Rhode Island have the country’s highest gambling tax rates, and all levy 51% on gross betting revenue.

Massachusetts is looking to join them, with Senate Bill 302 aiming to raise sports betting tax from its current 20% level to 51%.

The Massachusetts bill also seeks to elicit greater control over gambling advertising while also imposing affordability checks on players who wager more than $1,000 a day or $10,000 in a month.

West Virginia’s bills do not make such concessions. While the increases would not directly influence bettors, operators, faced with much higher tax liabilities, may look to pass these liabilities on, and opponents have highlighted Illinois as a cautionary tale.

The Prairie State introduced new tax rates last year that see the biggest operators paying 40% tax, plus a fee per bet.

In the following months, operators saw millions fewer bets placed by customers, thanks, in part, to DraftKings and FanDuel’s decision to pass that levy on to bettors.