Latest Casino & Betting News

Stay updated with breaking news, expert analysis, and industry insights.

TRENDING

Matthew Crist

2 days ago

TRENDING

Invincible Jeremie Aliadiere: Arteta The Right Man To End Arsenal's Title Wait

Arsenal invincible Jeremie Aliadiere spoke exclusively to Gambling.com.

0

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

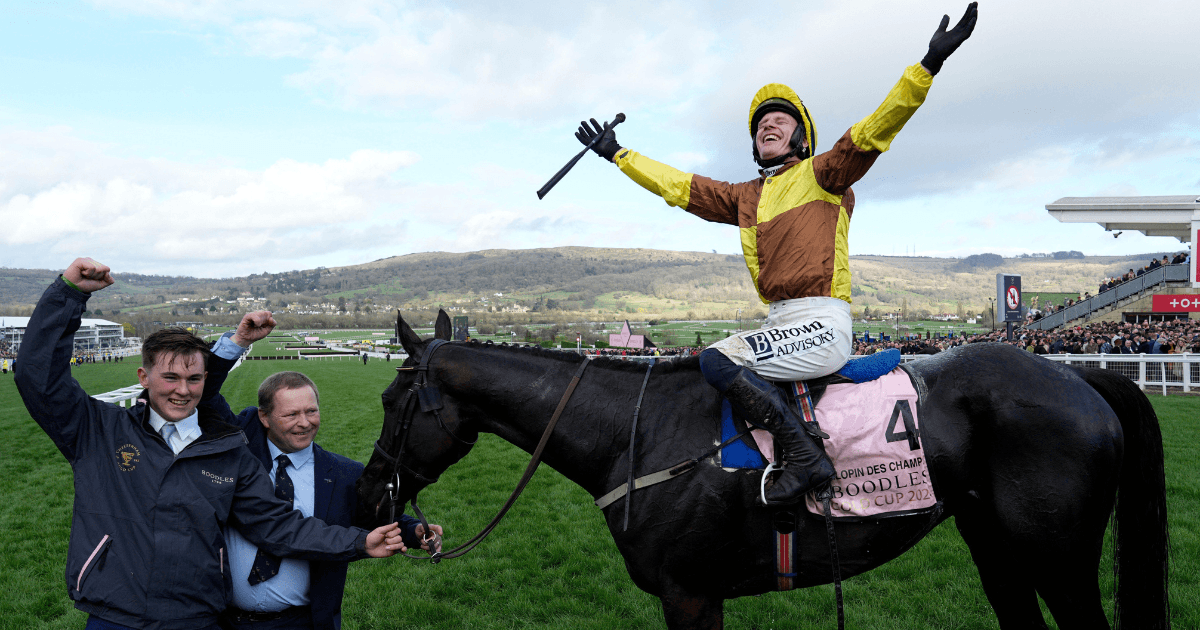

Cheltenham 2026 News

Latest Cheltenham Festival News

Horse Racing

© PA

Kevin Walsh

2 days ago

We look at the 10 biggest upsets in Cheltenham Gold Cup history and why it doesn’t always pay to fol...

Horse Racing

Diarmuid Nolan

2 days ago

Gambling.com and the Racehour's Diarmuid Nolan shares his Lucky 15 for Cheltenham 2026.

Horse Racing

© PA

Kevin Walsh

2 days ago

This page is dedicated to jockey Mark Walsh and his entries for today's racing.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Cheltenham 2026 News

Latest Cheltenham Festival News

Horse Racing

© PA

Kevin Walsh

2 days ago

We look at the 10 biggest upsets in Cheltenham Gold Cup history and why it doesn’t always pay to fol...

Horse Racing

Diarmuid Nolan

2 days ago

Gambling.com and the Racehour's Diarmuid Nolan shares his Lucky 15 for Cheltenham 2026.

Horse Racing

© PA

Kevin Walsh

2 days ago

This page is dedicated to jockey Mark Walsh and his entries for today's racing.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Casino News

Latest Casino News

Matt Jackson

2 days ago

The Quebec Online Gaming Coalition is pushing to follow Ontario into regulated online gaming.

Casino

Matthew Glazier

3 days ago

Enter $200 freerolls that are exclusively available to Gambling.com users.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Slots

Lucie Turner

3 days ago

Licensed operators would be able to offer digital slot machines, table games and live dealer games

Betting News

Latest Betting News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Football News

Latest Football News

Football

Andy Brassell

3 days ago

European football expert Andy Brassell shares his best tips for this weekend's action across Europe.

Football

© PA

Warren Barner

3 days ago

We look at the leading candidates to land the job on a permanent basis.

Football

Shaun Cronin

3 days ago

Tranmere Rovers are looking for a new manager after parting ways with Andy Crosby.

Football

Warren Barner

6 days ago

Gambling.com spoke to Joe Ledley, Charlie Mulgrew, Kelvin Wilson and Efe Ambrose about that night.

Horse Racing News

Latest Horse Racing News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Entertainment News

Latest Entertainment News

Strictly Come Dancing

James Leyfield

2 days ago

The iconic BBC ballroom show is searching for two hosts ahead of the new series.

TV

© PA

James Leyfield

3 days ago

One of the biggest standing ovations occurred after Sonny Green wowed the panellists with a poem.

TV

James Leyfield

4 days ago

A look at which celebs could feature in the next instalment of the hit show.

TV

James Leyfield

4 days ago

Viewers were treated to two epic Eliminators in the latest quarter-final battle.

Politics News

Latest Politics News

Politics

© PA

Paul Krishnamurty

5 days ago

Texas, North Carolina and Arkansas host the first batch of primaries.

Politics

Paul Krishnamurty

1 week ago

The Greater Manchester constituency will head to the polls on Thursday

Politics

Paul Krishnamurty

2 weeks ago

Labour are favourites with many bookmakers to win the most seats.

Politics

Paul Krishnamurty

3 weeks ago

The environmental party are favourites to win the Gorton and Denton by-election.

Latest AU News

TV

James Leyfield

1 month ago

The next James Bond film is on everyone's lips and we've looked at who could be his next adversary.

Football

© PA

Kevin Walsh

2 months ago

Ousmane Dembele won the award in 2024/25, but who will win the award next year?

Horse Racing

Gary Connolly

4 months ago

Will Al Riffa give the Irish another win in the Melbourne Cup?

Latest CA News

Latest IN News

© PA

Matthew Glazier

6 months ago

Gambling.com analyses the best odds on who will be the next permanent manager of Manchester United.

Aaron Murphy

6 months ago

Stay informed with the latest odds and expert analysis for the upcoming India vs Netherlands ODI Wor...

Kevin Taylor

6 months ago

The Premier League is on course to set a new record for goals scored in a game week. Four goals toni...

Latest IE News

Horse Racing

Kevin Walsh

3 days ago

This page is dedicated to jockey Paul Townend and his rides today.

TV

James Leyfield

1 month ago

The next James Bond film is on everyone's lips and we've looked at who could be his next adversary.

Latest NZ News

TV

James Leyfield

1 month ago

The next James Bond film is on everyone's lips and we've looked at who could be his next adversary.

Cian Kirby

1 month ago

Hundreds of lucky people around the world became millionaires only thanks to these five slots, of wh...

Latest UK News

Horse Racing

Kevin Walsh

13 hours ago

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

Horse Racing

Premium Content

Joe Norris - GYTO

13 hours ago

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

Horse Racing

Rhys Williams

1 day ago

Our racing tipster Rhys Williams shares his best selection for today's races.

Horse Racing

Matthew Glazier

2 days ago

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

Latest US News

Betting

Larry Henry

1 day ago

From discounts on rooms to reduced prices on food and beverages, Las Vegas casinos are offering deal...

Betting

Larry Henry

2 days ago

Some classic casino sites seen in movies are still around in Las Vegas and London.

Adam Arbon

3 days ago

Gambling.com analyzed Tripadvisor reviews for the four Native American casinos in the state.

Betting

Larry Henry

3 days ago

Bettors are wondering what will happen to their previous Arkansas sports betting accounts. Here are...