Gambling News

3 min read

Gambling.com's horse racing expert James Boyle will be providing his best tips here every day. Bookm...

2 min read

Playing this week's Dirty Dozen? Check out our cards cheatsheet ahead of this weekend's Premier Leag...

4 min read

Our racing tipster Rhys Williams shares his best selection for today's races.

43 min read

The Racing TV pundit gives his thoughts on the four-day meeting at Prestbury Park.

43 min read

Our racing expert brings you tips for every race at the festival!

3 min read

Our resident horse racing tipster Get Your Tips Out has built a Cheltenham Festival Acca just for yo...

2 min read

Our regular daily racing tipster Get Your Tips Out has identified a long shot for the Cheltenham Fes...

3 min read

Get Your Tips Out have joined forces with Gambling.com to give us their best bets of the day.

© PA

4 min read

Lord Sugar produced a triple bombshell in Thursday's latest episode.

3 min read

Gambling.com checks out some great special offers ahead of the meeting at Prestbury Park.

40 min read

The Cheltenham Festival Brain has all your bets sorted.

3 min read

Enter $200 freerolls that are exclusively available to Gambling.com users.

3 min read

Pick your runners, manage your budget and climb the leaderboard for a chance to win prizes every day...

1 min read

This page is dedicated to jockey Paul Townend and his rides today.

1 min read

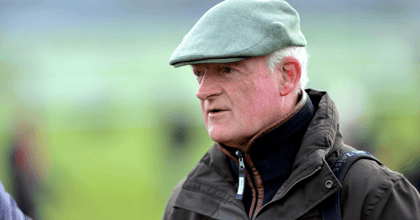

This page is dedicated to Willie Mullins and his entries today.

1 min read

This page is dedicated to Nicky Henderson's entries for today’s racing.

1 – 15 out of 60